5 Things That Happen At The End Of An IVA

When you enter into an IVA (Individual Voluntary Arrangement), you agree on a payment term with your creditors. The IVA usually lasts five to six years, after which the debts included within the arrangement will be written off and you will be debt free. Most things will be handled on your behalf by your Insolvency Practitioner, but it is still important for you to understand what happens once your IVA is completed. These are the key things that will happen at the end of your IVA.

1. Your Insolvency Practitioner will check your repayments

Before the IVA can officially be concluded, your Insolvency Practitioner (IP) will check that your repayments have been made in full. If they have not, the IVA will be extended and you will make further repayments until you have paid the agreed upon amount. They will also check that you have complied with any other obligations, like the sale of assets or equity release from your home, if applicable.

2. Make your final payment

Provided that you have made the rest of your payments in full, you can now make your final payment to your IP. Once they have received it, the IP will complete any final administration required on your account and make a final distribution to your creditors.

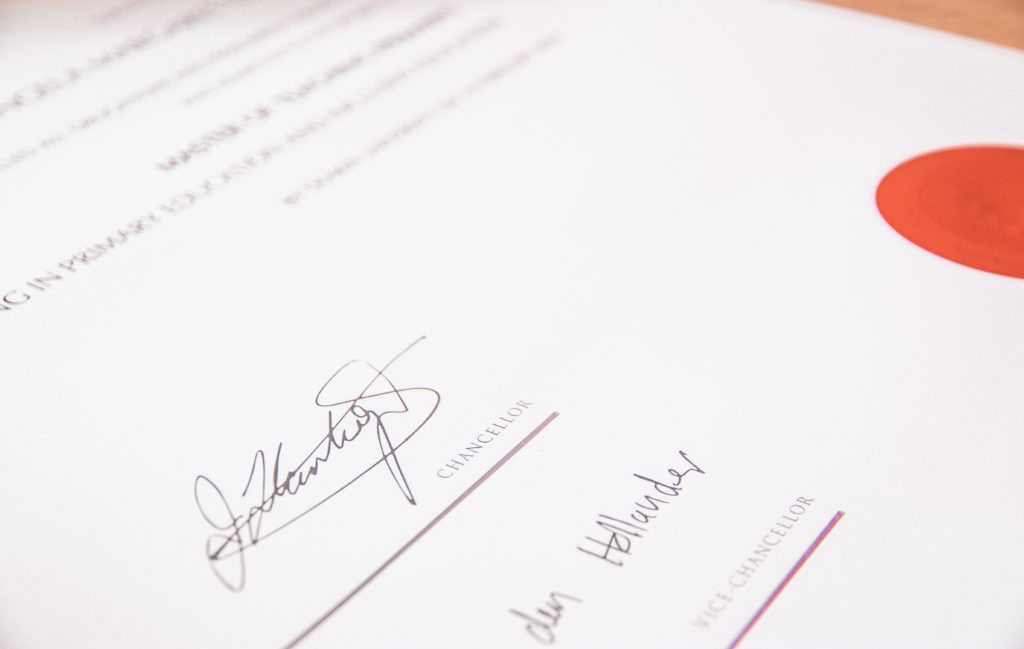

3. You will receive an IVA completion certificate

You will be sent a certificate to prove that you have made all payments towards your IVA and your debts are now officially forgiven.

After 3 months, your name should be removed from the insolvency register. However, you should double-check because this will not always be done automatically.

4. Your debts will be written off

Once you have received your certificate, the IVA is no longer in force and you’re released from your obligations under the arrangement. Once the creditors receive the certificate, they update their records and write off any remaining balance.

5. Enjoy a debt-free life!

Now that your IVA is completed, the debts that were included are now fully settled and you no longer have to make a monthly payment towards them. The disposable income that you were using to pay your IVA, is now freed up to use as you please. Not only do you have the peace of mind of being free from the burden of debt, but you should also have a more comfortable budget within which to manage your day-to-day living.

Do you require an IVA? Get in touch with Swift Debt Help today and we can support you throughout the process.

Request a Debt Assessment

Disclaimer: For guidance only. Financial information entered must be accurate and would require verification. Other factors will influence your most suitable debt solution.